Introduction –

The NMLS is an authority system that further develops purchaser assurances in the mortgage business. It guarantees that when you purchase a home, the mortgage experts included are prepared and licensed to help you. Become familiar with how the NMLS functions and how they secure and manage people and organizations. NMLS represents the Nationwide Mortgage Licensing System. It registers license data for mortgage loan originators (MLO) including both mortgage or loaning organizations and their loan officials and counsels. MLOs work with guarantors to qualify borrowers for their home loans. The NMLS permits you to look for loan officials and moneylenders to affirm their licenses are enrolled and meet industry necessities. You can also learn more about nmls test prep by clicking here on the link referenced.

Why NMLS System Has Been Introduced –

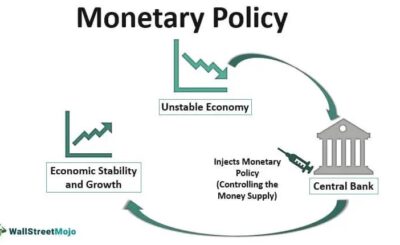

The reason for the NMLS is to advance responsibility inside the mortgage business and further develop correspondence among purchasers and organizations through data sharing. The NMLS is supported by the Protected Demonstration (Secure and Fair Implementation for Mortgage Licensing Demonstration of 2008) which expects there be a nationwide licensing and enrolment system for mortgage originators. Nonetheless, it’s vital to take note of that the NMLS doesn’t allow or deny licensure.

Does NMLS Requires Individuals Qualified to Have a License?

A NMLS license demonstrates a mortgage originator can give loan guidance that meets public and state prerequisites, is exceptional on their licenses, and is consistent with industry guidelines. Prerequisites for licensing fluctuate by state and incorporate fulfilment of NMLS and state coursework, breezing through the Protected assessment, passing a criminal history record verification, and a credit check. It regularly likewise remembers evidence of proceeded with training for the years following introductory licensure. A NMLS license accompanies a number, for all time connected to each organization, branch, or individual with a NMLS account. Loan officials that move states or switch organizations hold their novel license numbers, guaranteeing they remain appropriately licensed. The NMLS makes it simpler to confirm a mortgage originator is licensed to assist you with purchasing a home or renegotiate in your state. Having a public library for originators implies that it’s more straightforward to consider transgressors responsible and safeguard buyers from extortion. As well as utilizing the NMLS data set, you can see Opportunity Mortgage’s licensure by state here.

Can an MLO Help Individual in Purchasing a Home?

Opportunity Mortgage’s licensed Loan Counsellors, each with their own NMLS number, can help you purchase or renegotiate a home with traditional, VA, FHA, and USDA loans. To get a mortgage license through NMLS, first survey your state prerequisites by visiting the NMLS State Licensing Necessities page for your state. The page frames the documentation you might have to transfer and ship off the state organization. Before presenting an application, all state-licensed mortgage loan originators and certain people should breeze through the Public SAFE Act, MLO assessment, complete pre-licensure preparing, and present a crook individual verification and credit check. NMLS gives data on the particulars of every one of these prerequisites.

Organizations Enlisted with NMLS –

Make certain to arrange your application with your manager. On the off chance that your organization is enlisted with NMLS or enrolled in a state through the system, possibly you or your organization should finish Individual Structure (MU4) and pay related expenses. Assuming your organization is finishing your MU4 structure, sit tight for their course prior to continuing. While making a record in NMLS, guarantee that all data is precise, finished, and mirrors generally legitimate documentation. Errors can bring about at least one copy accounts (and can be expensive to fix).